When I was young, I rather save cash than purchase a property on my own. I don't want to commit to a huge monthly commitment. To be honest, I felt insecure able to keep my job for the long term.

What if I lost my job? I really don't want to put myself in a debts situation. Another factor to take into consideration is the surrounding environment may change in a long term. So, I don't buy property until my later stage. I make sure to have enough cash to settle off my house loan before committing the loan. Well, this is my way.

For those young people out there who are planning to buy a house, take the factors below before making your long term commitment decision.

The Pros Of Buying A House

Better Privacy and Control Over Your Space

You can create your dream living space freely. As long as the local authority permits, you can renovate and decorate your living space to your liking without house owner approval because you are the owner.

Long Term Stability

You are unlikely to move out from your own house unless there is a major event such as job relocation or whatsoever. Even if you decide to sell off the house, you may need to wait for at least five years for the value to increase to make it worth it. For married couples with children, this will be a great inheritance to pass down to the children. As for single people, worry not. Recently, I read about some offerings by Cagamas on a Collateral Retirement Scheme to fund your retirement. This is to ensure your retirement days are fully taken care of. I won't elaborate further on this but you can explore this if you are 55 years and above to fund your retirement.

Better Credit Score

The most important about loan repayment is to pay on time to improve your credit score. Why is it important to improve credit score? Simple. A good credit score just makes life easier. You can have better access to other financial products and can get good interest rates on other loans.

Building Equity

Well when you purchase a house, rather than your monthly payment rent going to a landlord, it will end up increasing your long term asset value. You can consider cashing out via refinancing a portion of your home equity, especially during a hard time. Take the current pandemic situation. Many of us were affected such as losing our job and so on. Even taking the 6 monthly moratoria offered by the banks isn't enough to make our life goes on. You can use the refinancing methods to improve your cash flow to keep you and your family going. You may discuss with your banker the better interest rates or whatsoever. Before meeting your banker do some research to ensure you know what you get yourself into. For example, you can do some calculations on how much to expect from home refinancing. You can get the estimated amount and start your negotiation. At least in this way, you could lower the monthly home loan repayment.

The Cons Of Buying A House

High upfront cost

Well, you need at least a 10 to 20% down payment to purchase a house. But there are some offerings on the 0% downpayment. As usual good offer comes with a price tag along with it. So expect the 0% downpayment to come with a much higher loan interest rate. Bear in mind you are to commit and live with high interest for a long term tenure.

Less Flexibility

When you purchase a house, you a kind of rooting with it and not easily switch from buy to rent. If you are purchasing with an investment in mind. You have to make sure there is a tenant. Imagine you can't find a tenant in one or two years. You have to pay the loan and maintenance cost along with utilities and other house expenses.

Taxes and other regular fees

As a homeowner, expect to pay more fees other than just monthly loan repayment. In Malaysia, there is a hidden cost that many people neglected when considering purchasing a house.

Property assessment tax (cukai pintu) - this tax is imposed by the local authority. The tax is calculated based on the estimated annual rental value of a property. In general, the rate is 4% for residential and 10% for commercial property. The amount will be multiplied by 12 months. This amount is to be billed in two instalments annually.

Quit rent (cukai tanah) - this one is collected by the State Governments and is imposed on owners of freehold or leased land. The rate may differ for different locations.

Home insurance - there are many types of insurance to cover damages caused by theft, natural disasters, fire and many other risks.

Mortgage insurance - there are two types of mortgage insurance available.

* Mortgage Reducing Term Assurance (MRTA) or Mortgage Decreasing Term Assurance (MDTA)

* Mortgage Level Term Assurance (MLTA)

Sewerage bills - In Malaysia, other than electricity, water bill, we have to pay Indah Water for the cost of operating and maintaining public sewerage plants and underground networks for sewerage pipelines.

Maintenance fees - most of the house is it landed or high rise apartment to pay maintenance fees to the management office on monthly basis. Other than maintenance fees there are sinking funds to pay too.

Maintenance and repair cost

Many young buyers thought you just need to save for downpayment to own a house. They don't really see there are other costs to be borne apart from just downpayment. You need to prepare emergency repair costs, Just set aside at least 1% to 3% of your house purchase price annually to cover up home maintenance and upkeep. It is a good idea to do so you don't get caught off guard with the sudden cost.

Long term loan commitment

Always bear in mind that you will have to commit 20 to 30 years for the house loan repayment. To make sure you can afford the house loan repayment for the long term, make sure you know the rough calculation before considering buying a house. Always purchase a house suited to your affordability in a long term. Do the math before committing yourself.

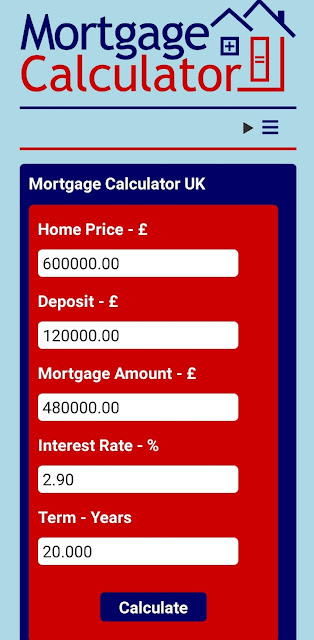

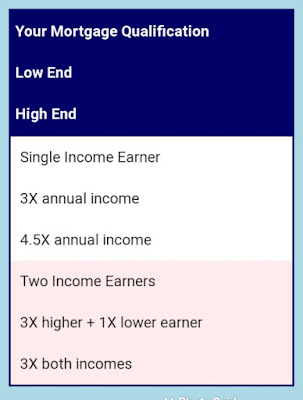

I calculate the estimated monthly home loan repayment to suit my budget. Let us do some case study here (Ignore the currency, just make use of the calculator. The math formula is the same globally. ) :

Alice is planning to buy a house.

House price: 600,000

Interest rate : 2.9% p.a

Loan Tenure: 20 years

Downpayment : 20%

Now that you have read some of the points of buying a house. I would say my decision to continue renting at a young age is the best decision. Next, let us look into the pros and cons of renting a house instead of buying.

The Pros of Renting a House

👉 Monthly rent is way affordable if to compare it with purchasing your own.

👉 You can downgrade yourself to a much cheaper place if your financial situation is not permitted to enjoy the luxury

👉 The maintenance and repair cost of the house is born by the landlord

The Cons of Renting a House

👉 Rent can increase at any time

👉 Tied up with many rules and regulations set by your landlord

👉 Expect any time eviction. So, don't even think about feeling settle down.

👉 If you love pets - expect to live apart from your beloved. Some owners don't allow pets in the house

👉 You can't do any renovations to the place to suit your dream house ID

Now that I have analysed to you about buying your own house and renting, you can bring it together and compare between buying vs renting a house. The facts listed above is a good point for a big decision such as buying a house. Do more research such as whether you are ready to commit a long term journey commitment. Only you know what is right for you! Just don't go beyond affordability.

You can also explore some of our government projects such as the 'PR1MA housing scheme' for a more affordable home. Take advantage of the 'My First Home Scheme' as well and enjoy more benefits and savings out of it. Don't just apply for the home loan from one bank but try to explore various banks for better interest rates and packages.

Comments

Post a Comment

Thank you for dropping by...